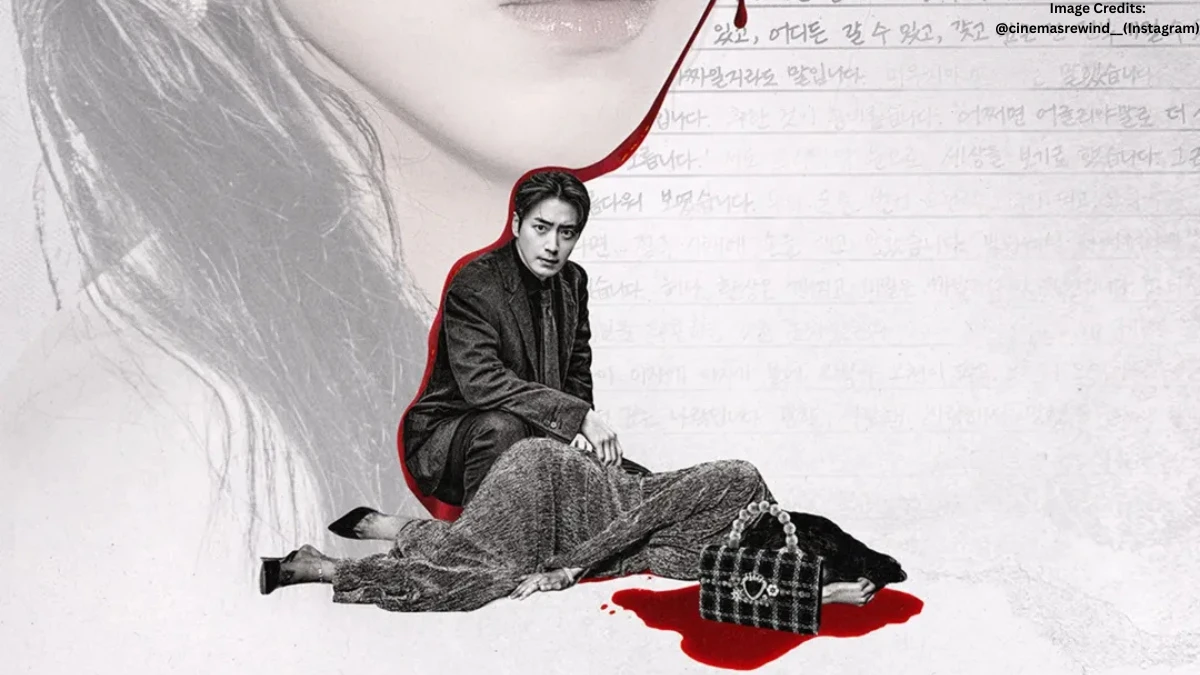

Personal Loan Interest Rates 2025: ICICI Vs HDFC Vs IDBI Bank Vs SBI Vs Post Office Vs Bajaj Finserv Vs Kotak Mahindra Bank

So, you’re thinking of taking a personal loan in 2025? Great! But before you jump in, let’s talk about the real deal interest rates. They’re like the fine print that decides how light (or heavy) your EMIs feel every month. Here’s a friendly breakdown of what the big banks and lenders are offering right now.

|

Bank / Lender |

Interest Rate (p.a.) |

|---|---|

|

ICICI Bank |

10.60% – 16.50% |

|

HDFC Bank |

9.99% – 24.00% |

|

SBI (State Bank of India) |

10.05% – 15.05% |

|

IDBI Bank |

11.00% – 15.50% |

|

Bajaj Finserv |

10.00% – 31.00% |

|

Kotak Mahindra Bank |

9.98% – 17.99% |

ICICI Bank

Rate band: 10.60% to 16.50% p.a.

Who tends to get the lower side (~10.60%–12%)?

-

Salaried folks with stable jobs (especially in known companies)

-

Those with good CIBIL / credit score (700+ or more)

-

People in higher income brackets

-

Applicants in metros / better lending geographies

Who ends up on the higher side (14%–16%+)?

-

Lower income / higher risk profiles

-

Self-employed professionals or non-professionals with less business vintage

-

People with a weaker credit history or past defaults

Other eligibility notes:

-

For salaried: age between ~20–58 (at maturity)

-

For self-employed: higher max age (up to 65)

-

Minimum work/business vintage: 2 years in current business / total experience criteria

-

Minimum monthly income or turnover thresholds for self-employed are applied (varies by city)

HDFC Bank

Rate band: 9.99% up to 24% (depending heavily on profile)

Who gets the better end (~10%–13%)?

-

Salaried employees with stable, well-paying jobs

-

People with strong credit histories

-

Those with relationship (existing banking relationship) with HDFC

Who faces steeper rates (15%–24%)?

-

Riskier profiles: lower income, inconsistent employment

-

Self-employed with less stable or seasonal business

-

Borrowers with lower credit scores or earlier delinquencies

Eligibility cues:

-

HDFC states loans up to ₹40 lakh in some cases

-

Interest rate and tenure calculators available online for different slabs

SBI (State Bank of India)

SBI uses 2-year MCLR + spread. Current spread band is 1.25% to 6.25%, making effective rates 10.05% to 15.05% p.a.

Who gets the lower spread (hence lower rate)?

-

Salaried borrowersespecially govt, large corporate employees, stable profile, good credit score. Possibly those with relationships (salary account) in SBI.

Higher spread (toward 6.25%) reserved for riskier profiles:

-

lower salary, weaker credit history, possibly newer job / short tenure.

IDBI Bank

IDBI’s typical quoted band: 11.00% to 15.50% p.a.

Lower side (11-12%) is likely for salaried applicants who have stable employment, good credit record, possibly maintain salary accounts / relationship with IDBI.

Higher side (~14–15.50%) for applicants with less income stability or higher risk (self-employed without long track record, borderline credit scores)

Bajaj Finserv

Rate band: ~10% to 31% p.a. depending heavily on risk factors. (Mentioned in your earlier info)

Who gets the 10%–15% side?

-

Borrowers with excellent credit scores

-

Low existing debt, good repayment history

-

Salaried individuals in stable jobs

Who gets the high side (20%–31%)?

-

High-risk profiles: low credit score, past defaults

-

Self-employed or irregular income persons

-

Borrowers with multiple existing loans / high debt burden

Eligibility flavors:

-

Strong credit history is a must

-

Income proof, business vintage, credit score heavily weighed

-

Prepayment / foreclosure penalties are steeper for higher risk borrowers.

Kotak Mahindra Bank

Rate band: starting ~9.98% (for top profiles)

Who qualifies for ~9.98% or close?

-

High salaried professionals with strong credit

-

Applicants in top credit score brackets

-

Borrowers in strong credit history zones with low risk

Who gets higher rates?

-

Borrowers with less income, moderate or weak credit profiles

-

Self-employed / business owners with variable income

Eligibility hints (from general practice):

-

Minimum income / tenure criteria

-

Prior banking relationship may help

-

Standard checks on credit score, existing debts, and job stability

Post Office

The Indian Post Office does not directly offer personal loans but acts as a referral service for loans provided by partner banks and non-banking financial companies (NBFCs). The interest rates for these personal loans vary depending on the specific partner lender, your credit profile, income, and other factors.

-

Axis Bank: 10.50% to 25.00% (fixed).

-

HDFC Bank: 10.50% to 25.00% (fixed).

-

Aditya Birla Capital Ltd: 11% to 24.00% (fixed).

-

FIBE: 1.5% to 2.5% per month.

Disclaimer

This comparison is for informational purposes and does not constitute financial advice; personal loan rates and terms are subject to change by individual banks. Always verify the latest rates and conditions directly with your chosen lender before applying for a personal loan.