10 Tiny Habits That Make You Rich

Here are 10 tiny habits that consistently help people build wealth and move closer to financial freedom. These habits may feel small, but when practiced daily, they quietly compound into significant results over time.

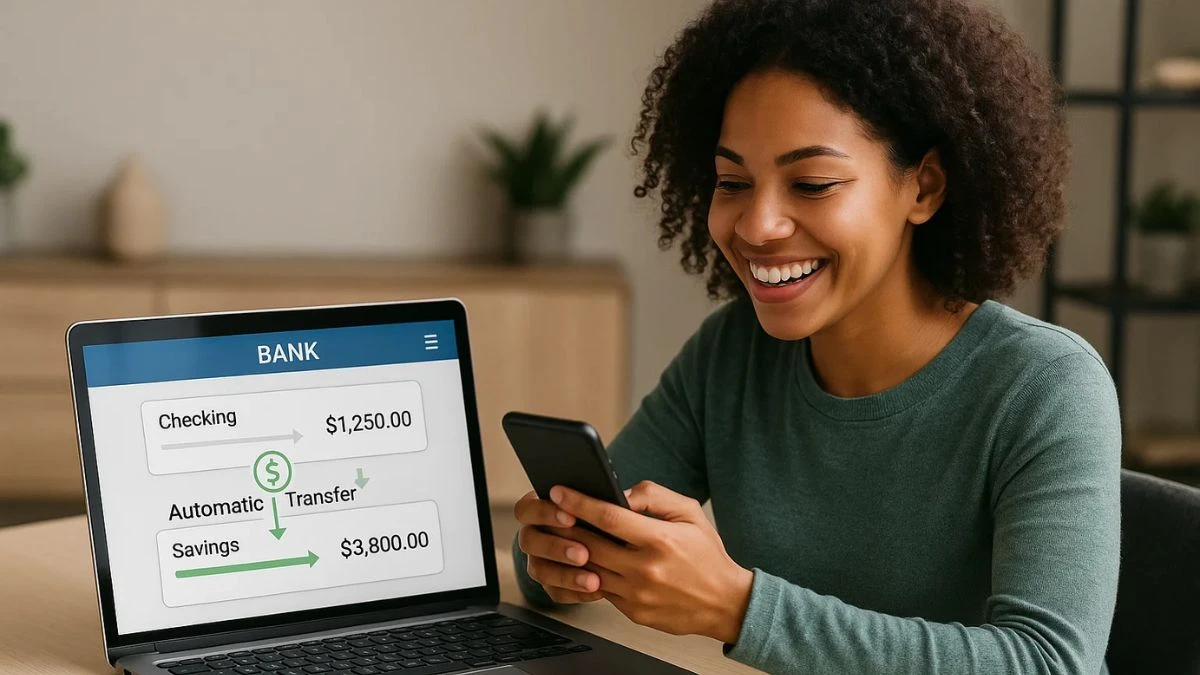

1. Pay Yourself First

Before handling bills or discretionary spending, set aside a fixed percentage of your income in savings or investments. Automating this transfer ensures you always prioritize your long-term financial health over short-term temptations.

2. Review Your Finances Daily

Spending a few minutes each day monitoring your accounts increases awareness and prevents surprises like overdrafts or fraud. Regular check-ins help you stay in control and spot potential issues before they escalate.

3. Learn Something About Money Every Day

Dedicating just 10 minutes daily to financial reading, podcasts, or videos expands your financial literacy over time. This constant learning empowers smarter decisions and helps you avoid common money traps.

4. Track Your Expenses

Recording every purchase uncovers wasteful habits and lets you redirect funds toward your goals. Using a notebook or app makes it easier to see where adjustments are needed for better savings.

5. Invest Consistently (Even Tiny Amounts)

Small, regular investments grow steadily through compounding, even when starting with modest sums. Setting up autopilot contributions takes the emotion and timing out of investing, ensuring progress month after month.

6. Build Multiple Income Streams

Start a side hustle, monetize a skill, invest in passive income vehicles, or sell digital products. This “silent income” helps generate wealth beyond your regular paycheck.

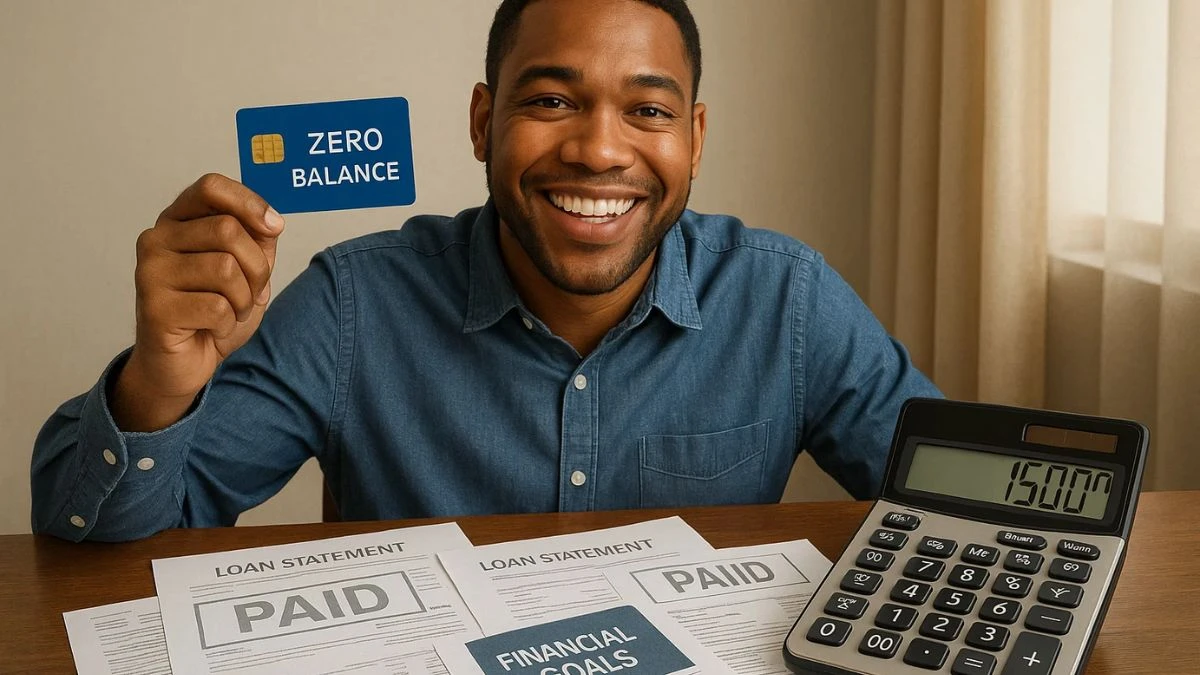

7. Avoid Debt and Manage It Wisely

Limiting high-interest borrowing preserves your cash flow and prevents wealth erosion. If you must take on debt (like for a house), prioritize quick repayment to avoid unnecessary interest expenses.

8. Network Consistently and Give Value

Building relationships through genuine interest and helpfulness can lead to opportunities you wouldn’t find alone. Helping others and staying in touch expands your access to guidance, clients, or investments.

9. Upgrade Your Skills

Regularly sharpening your skills—digital, entrepreneurial, or technical—boosts your potential to earn more and stay relevant. This investment in yourself translates directly into greater career or business income down the line.

10. Practice Gratitude and Mindful Spending

Taking time to appreciate what you have reduces the urge for unnecessary shopping and impulsive splurges. Mindful spending not only saves money but improves overall financial contentment and life satisfaction.

Why Tiny Habits Work

Wealth-building isn’t about grand gestures it’s about incremental improvements repeated thousands of times. These habits focus on automation, self-awareness, education, and building networks, creating momentum for sustained growth.

Tips for Implementation

-

Start with three habits and add more once your routine is stable

-

Use reminders and automate as much as possible

-

Track progress and celebrate small wins

-

Keep in mind, these habits work for everyone, regardless of starting income or background consistency is what truly matters.