5 Best Post Office Schemes with Higher Returns than FDs

Are plain old FDs starting to feel like parking your cash in a time capsule? If you’re nodding, you’re not alone. For years, my dad swore by five-year fixed deposits as the ultimate “safe bet”—something about “not risking your retirement savings on market mood swings.” But here’s the rub: with inflation quietly eating away at returns and FD rates trailing at around 6-7% in most banks, more folks (including him!) are peeking over the fence at India’s post office schemes. These government-backed favorites don’t just give better yields—they bring peace of mind that feels a little bit like mom’s homemade snacks. Let's dig into them—the relatable way.

1. Post Office Monthly Income Scheme (POMIS): Steady, Predictable Income

If monthly income is what you crave, POMIS might be the friend you never realized you needed. This scheme delivers interest straight into your account each month, like clockwork—while your nest egg sits pretty until maturity.

Back when my neighbor Mrs. Iyer retired, her family threw her a tea party—and every single auntie had a story about missing pension payments or random bank “holidays” that stall withdrawals. She picked POMIS for the simple reason that the money arrives on time, every month, no drama.

- For whom? Indian residents over 18 who want reliable income, not drawn-out principal erosion.

- Interest Rate? Usually above major bank FDs; recently, it’s hovered around the 7.4% mark.

- Fun Fact: NRIs can’t participate, so if your cousin’s “training in Texas,” tell him to look elsewhere.

2. Senior Citizens Savings Scheme (SCSS): Best for Retirees Who Deserve a Break

SCSS is a classic. If your parents (especially those over 60) receive retirement benefits—gratuity, final settlements, or just want a place for lifelong savings—this scheme is practically tailor-made. The returns show up quarterly, which means there’s money for samosas at every family reunion.

My uncle, ever the skeptical banker, finally relented when he realized that SCSS keeps both principal and interest steady as a rock. Unlike the SBI Annuity Deposit Scheme, where your money continually dwindles, SCSS lets funds sit undisturbed. He now calls it his “peace-of-mind account.”

- Invest once, enjoy returns for 5-8 years.

- Principal stays untouched; quarterly interest is predictable.

- If you skip collecting your quarterly payment, don’t expect extra; it isn’t compounded.

3. Sukanya Samriddhi Yojana (SSY): For Girl Child’s Big Dreams

If your household includes a daughter (or two), and relatives keep asking “What’s her future plan?”—SSY is a no-brainer. It’s not just about higher interest, but the fact that both the investment and its returns are tax-free. That’s right, zero taxes, which feels almost magical these days.

My friend Ruchi started SSY when her daughter turned one—partly on her mom’s “don’t delay good things” advice, partly because she wanted more options for college and wedding expenses down the line. Whenever she checks the passbook, there’s a small thrill: compounding magic on display.

- Who can open? Parents or guardians, any time before the girl hits 10.

- Deposit period: Pay for 15 years, interest grows until 21-year maturity.

- Open? At post office, SBI, or almost any major public sector bank.

4. National Savings Certificate (NSC): Grow Safely, No TDS Cuts

Here’s a scheme that feels retro but delivers modern returns. NSC is all about predictability, with zero TDS at maturity—so every rupee reaches your hands, not the taxman’s pocket. It’s safe, paper-based (though slowly digitizing), and doubles as collateral for loans if emergencies arise.

When my cousin lost his job last year, he discovered his NSC certificates could help him secure a bridge loan. No drama, no sudden “charges.”

- Mature in 5 years, so you’re not locked out for a decade.

- Rates often edge above 7%, recently trouncing regular bank FDs.

- Works for individuals over 10—so yes, students can start building a nest egg early.

5. Public Provident Fund (PPF): The Tax-Saver’s Old Faithful

PPF is like that reliable friend who never cancels plans. If you’re tired of juggling market volatility, PPF gives pure, predictable growth. You can open it for as little as ₹500 a year; this keeps the scheme going and entices procrastinators (“I’ll start next year...”) to act.

My father opened his PPF ages ago. Every time the statement lands, he grins about “tax-free interest,” which remains untouched by the usual rounds of government tinkering.

Why PPF Still Wins

- All returns are exempt from tax.

- Extendable after maturity for extra growth years.

- No asset allocation or fancy monitoring needed—unlike mutual funds, you won’t get nervous reading the business news.

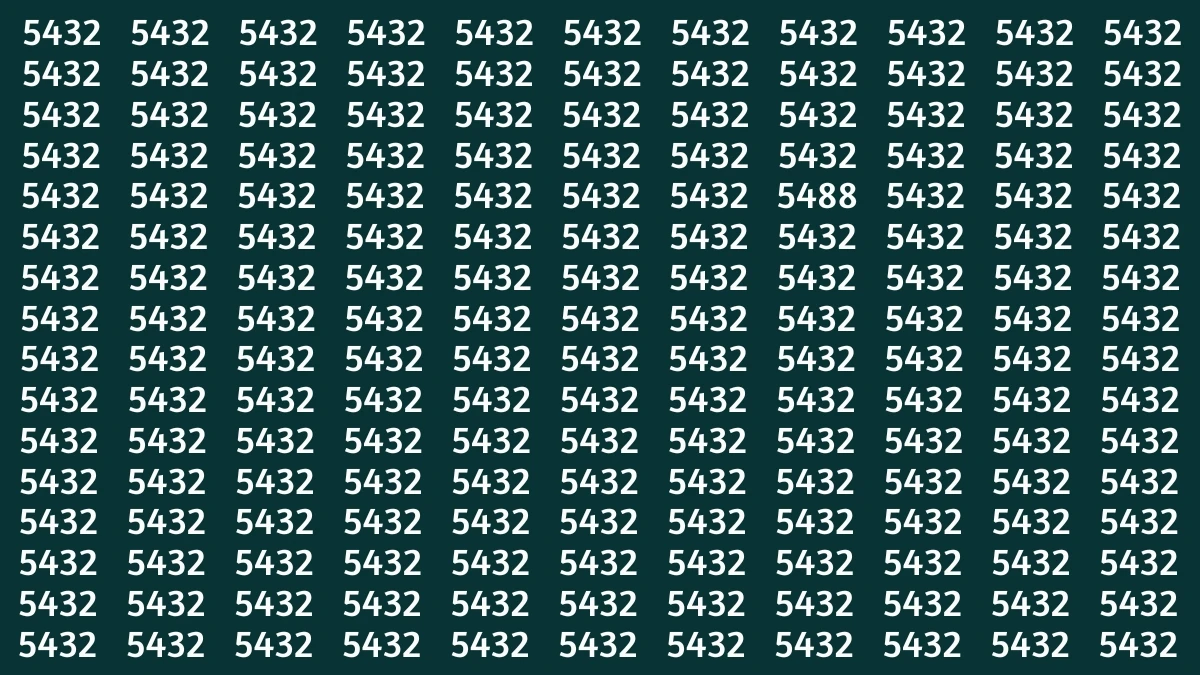

Post Office vs. Regular FDs

| Scheme | Typical Rate (2025) | Income Frequency | Lock-in/Term |

|---|---|---|---|

| POMIS | ~7.4% | Monthly | 5 years |

| SCSS | ~8.2% | Quarterly | 5-8 years |

| SSY | ~8.0% | Accrues, at maturity | Till girl is 21 |

| NSC | ~7.7% | At maturity | 5 years |

| PPF | ~7.1% | Accrues, at maturity | 15 years |

If You Want to Beat Inflation—Here’s the Real-Life Verdict

Not every scheme fits every scenario, and it’s perfectly normal to mix post office options with other finance plans. Just last spring, my aunt called in a panic about her FD rates ending up “less than the milkman’s raise.” With a combo of SCSS and PPF, she now actually likes checking her balances. Sometimes, happiness really is a quarterly interest credit.

These government-backed jewels blend safety, predictability, and better returns than standard FDs. The real trick is picking one (or a few) that match life as you live it.