Saatvik Green Energy IPO GMP

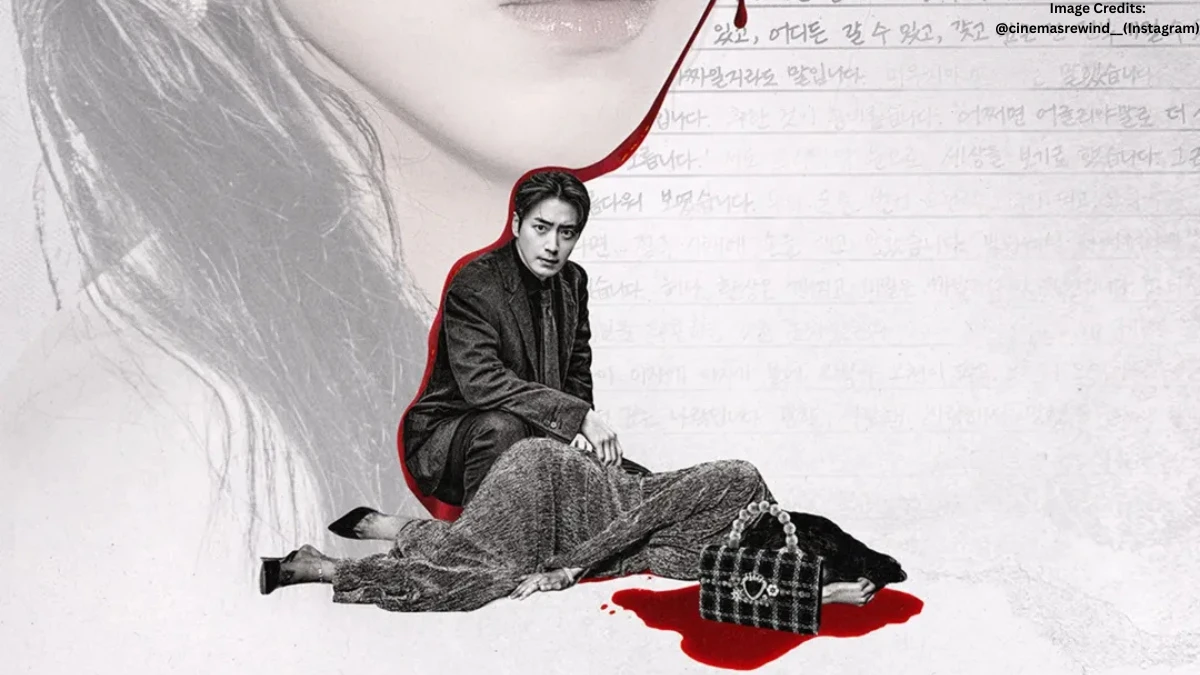

Saatvik Green Energy’s IPO Grey Market Premium (GMP) is seriously buzzing, and in the most literal sense—there’s genuine excitement in the market right now. The latest GMP sits at about ₹78, which pegs a hopeful listing price of ₹543 per share against the cap price of ₹465. That’s roughly a 17% premium, and if you’re anything like me, those kinds of numbers make you start running mental simulations for Day 1—like, will my phone die from all the notifications? Or will I finally have a reason to brag about “catching a green wave” at the chai stand?

Some folks are speculating that this pop could be short-lived, though. The GMP has been stable for a couple of sessions, and you know how moody grey market traders are—one bad news headline and everyone acts like their cousin borrowed their motorcycle and never returned it. Still, 17% is hard to ignore, especially for green energy, which feels somehow more poetic—and maybe, slightly smug—than a standard finance play.

Saatvik Green Energy IPO Dates

For anyone who can barely plan their lunch, let’s get crystal-clear on the IPO schedule, because missing this window would feel like forgetting your best friend’s wedding anniversary. The anchor book bidding is live on September 18, and the main IPO subscription period runs from September 19 to September 23. That’s barely enough time to have that “Should I, shouldn’t I?” debate, so you might want to keep notes by your bedside.

Here’s the rundown, in case your calendar is scattered:

- Anchor investor window: September 18

- Main issue subscription: September 19 – 23

- Share allotment: Expected September 24

- Listing date: Tentatively September 26 on both BSE and NSE

IPO Structure & Lot Sizes

This IPO is an interesting beast: a Rs 900 crore total offering, split between a fresh issue (1.51 crore shares, Rs 700 crore) and an offer-for-sale by promoters (0.43 crore shares, Rs 200 crore). Price band: ₹442–465. Minimum retail chunk? 32 shares. At the upper band, that’s an outlay of ₹14,880 (or basically three nights out in Mumbai if you’re reckless).

NIIs get a bit more math to chew on:

- Small NII: 448 shares (14 lots) for ₹2,08,320

- Large NII: 2,176 shares (68 lots) for ₹10,11,840

If that sounds intimidating, just remember: everyone started from ₹0 once—even the guy who invented solar panels.

What’s With The GMP Excitement?

Anecdotally, a neighbor pulled me aside last week, armed with WhatsApp screenshots and more drama than the last family wedding. “17% pop!” he whispered, as if it was code for a stock market heist. The GMP is the street’s pulse—that back-alley, slightly rebellious way to measure what retail and flipper investors REALLY think, before the big institutions try to rationalize everything with 100-slide PowerPoints.

But tread carefully—the GMP is fickle. It’s like that friend who promises you concert tickets, then winds up in Goa instead. Yet a premium near 17% (₹78 over the cap price) tells you there’s palpable optimism that could flicker—or flame out—by listing day.