If you're aiming for a steady government role in Madhya Pradesh's revenue department, the MP Patwari position through MPESB (also known as MP Vyapam) offers reliable pay and long-term security.

This job involves key responsibilities in land records and rural administration, making it a popular choice among state government aspirants.

We'll cover the basic pay structure, how allowances add up, your likely in-hand take-home, deductions, and how earnings evolve after 5, 10, and 15 years, based on the standard 7th Pay Commission guidelines followed in MP.

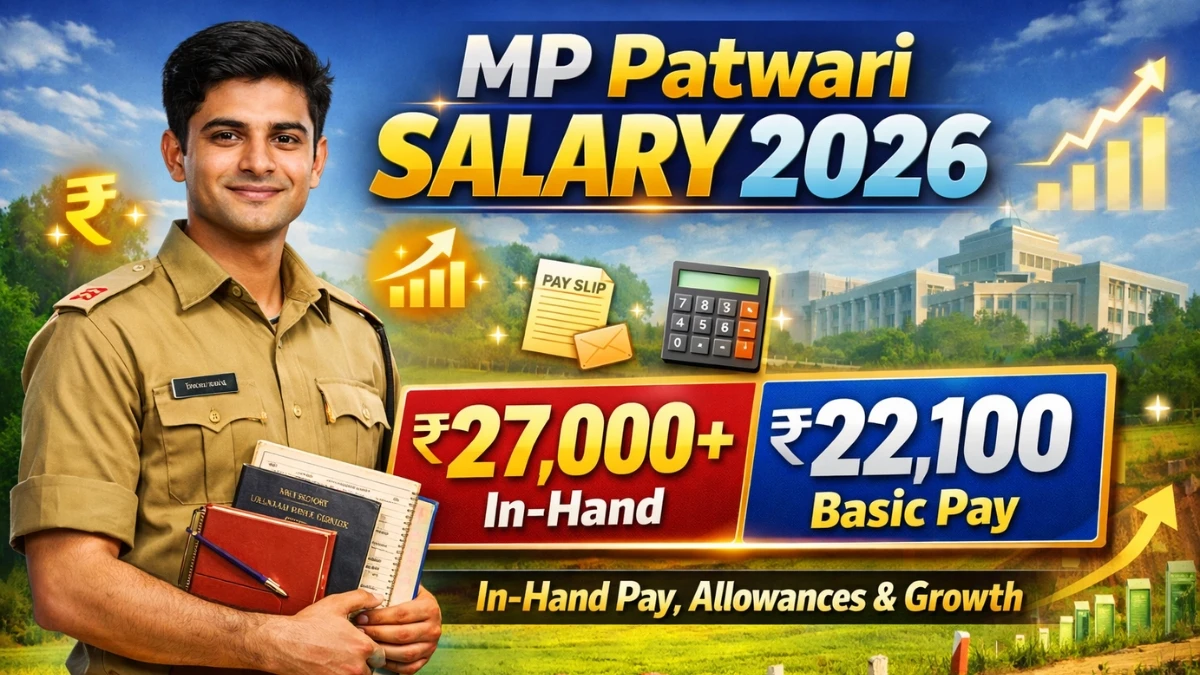

MP Patwari Salary 2026 Overview

The MP Patwari role falls under the revenue department, with salary aligned to the state's adoption of the 7th Pay Commission principles. While older notifications reference the pre-revised pay band, the effective starting pay reflects revised equivalents for entry-level positions.

MP Patwari Salary – Key Highlights

Here's a quick snapshot of the essentials:

| Aspect | Details |

|---|---|

| Recruiting Body | MPESB / MP Vyapam |

| Post Name | MP Patwari (Revenue Department) |

| Pay Matrix | 7th Pay Commission (state matrix) |

| Pay Band (pre-revised) | PB-1: ₹5,200 – ₹20,200 |

| Grade Pay | ₹2,100 (commonly referenced; some sources note ₹2,400) |

| Revised Basic Range | Approx. ₹22,100 starting, up to around ₹70,000 at max |

| Starting In-Hand Salary | Approx ₹27,000 per month (varies with DA, HRA, and deductions) |

MP Patwari Salary Structure 2026 (7th Pay Commission)

The salary follows MP's implementation of the 7th Pay Commission framework, shifting from older pay bands to revised basics with built-in growth.

Pay Scale, Grade Pay & Pay Level

The traditional pay band is ₹5,200–₹20,200 with grade pay of ₹2,100 (or ₹2,400 in some references). In practice, this translates to a starting basic pay of around ₹22,100 under the revised matrix, scaling up to approximately ₹70,000 at the top end through increments.

MP Patwari Salary Components

Your monthly pay includes several fixed and variable parts:

-

Basic Pay (starting): Around ₹22,100, this is the core figure that grows with time.

-

Dearness Allowance (DA): A percentage of basic to counter inflation; recent state updates set it at 34% effective from September 2025, paid from October onward.

-

House Rent Allowance (HRA): Typically 14% of basic, depending on your posting city or rural area.

-

Travel/Transport Allowance (TA): A fixed amount for commuting and official duties, often in the ₹1,000–₹2,000 range.

-

Other allowances: Include minor departmental or local benefits as per MP government orders.

MP Patwari In-Hand Salary 2026

In-hand pay is what reaches your account after adding allowances and subtracting mandatory cuts. Realistic expectations hover in the mid-20k to low-30k range for starters.

Monthly In-Hand Salary on Joining

MP Patwari's in-hand salary is calculated using Basic Pay + Allowances (DA, HRA, etc.) – Deductions (PF/NPS, tax, etc.).

As per your assumed structure:

-

DA = 34% of Basic Pay

-

HRA = 15% of Basic Pay

-

PF/NPS deduction = 10% of Basic Pay (you mentioned this)

Note: DA/HRA rates can change based on Madhya Pradesh government orders and posting city category, so the final in-hand figure may vary.

Minimum MP Patwari In-Hand Salary (Example)

-

Basic Pay: ₹22,100

-

DA (34%): ~₹7,500

-

HRA (15%): ~₹2,700

-

PF/NPS Deduction (10% of basic): ~₹2,210

Estimated in-hand (approx.): ₹27,000–₹34,000/month (varies with other allowances and deductions)

Maximum MP Patwari In-Hand Salary (Example)

-

Basic Pay: ₹70,000

-

DA (34%): ~₹23,800

-

HRA (15%): ~₹10,500

-

PF/NPS Deduction: should be ~₹7,000 if calculated as 10% of basic (not ₹5,690)

Estimated in-hand (approx.): depends heavily on tax, NPS structure, and other deductions, but it will be significantly higher than the minimum slab.

MP Patwari Salary Deductions 2026

While the gross salary of an MP Patwari includes basic pay and allowances, several mandatory deductions are applied before the final in-hand amount is credited. These deductions are standard for most Madhya Pradesh government employees and are primarily related to retirement savings and statutory contributions.

Major Deductions in MP Patwari Salary

1. National Pension System (NPS)

-

One of the biggest deductions is the employee’s contribution to the National Pension System (NPS).

-

Typically, 10% of Basic Pay (and sometimes Basic + DA depending on rules) is deducted monthly.

-

The government also contributes an equal share separately, which benefits the employee in the long term.

-

2. Provident Fund / Retirement Contributions

- In some cases, retirement-related contributions are adjusted under state rules alongside NPS deductions, depending on service conditions and departmental guidelines.

3. Income Tax (If Applicable)

-

Income tax is deducted based on the employee’s total taxable income and chosen tax regime.

-

At the entry level, deductions may be minimal or zero depending on allowances and exemptions.

-

As salary increases with increments and promotions, tax deductions may rise.

-

4. Group Insurance / Professional Tax

-

Small deductions may include:

-

Group insurance schemes

-

Professional tax (if applicable under state rules)

-

Welfare fund contributions

-

-

These are usually minor but appear in the salary slip.

Example Deduction Calculation (Approx.)

-

Basic Pay: ₹22,100

-

NPS Deduction (10%): ~₹2,210

-

Other deductions (tax/insurance): ₹300–₹1,000 (varies)

Total deductions: Approx. ₹2,500–₹3,500 per month (at entry level, indicative)

Note: Exact deductions vary based on posting location, tax declarations, and government policy updates. Candidates should always refer to the official MPESB or state government notifications for the latest rules.

MP Patwari Salary 2026 Allowances & Benefits

Allowances help bridge living costs and job demands, while benefits provide long-term stability.

Major Allowances for MP Patwari

-

Dearness Allowance (DA): Adjusted periodically for rising prices, currently at 34% following the latest state revision.

-

House Rent Allowance (HRA): Varies by posting (higher in urban areas, lower in rural).

-

Travelling/Transport Allowance (TA): Covers daily travel and field work.

-

Other allowances: Departmental extras as outlined in the MP government rules.

Perks & Long-Term Benefits

You get NPS-backed retirement savings, gratuity on superannuation, paid leaves, medical facilities through state schemes, and the security of a permanent government position.

MP Patwari Salary After 5 Years, 10 Years & 15 Years

Government jobs shine in predictable progression, annual increments plus DA revisions steadily lift your earnings.

MP Patwari Salary After 5 Years

With regular 3% increments in the matrix, your basic pay rises after five years, boosting DA and HRA proportionally. In-hand can climb noticeably higher than starting levels—often into the ₹40,000+ range, depending on DA updates and posting.

MP Patwari Salary After 10 Years

Mid-career brings a higher basic within the scale, plus possible first promotions (like Senior Patwari or Revenue Inspector equivalents). Combined with ongoing DA hikes, in-hand salary moves toward mid-to-upper band values.

MP Patwari Salary After 15 Years

Over the long haul, multiple increments and promotions (potentially to Naib Tehsildar or higher) shift you to elevated pay levels. In-hand can exceed ₹50,000–₹70,000+, with allowances scaling up. Exact amounts depend on promotions, DA percentages, and any state pay revisions; always check official sources for updates.

MP Patwari Annual Package 2026

Starting gross multiplied by 12 gives an annual figure around ₹4.5–₹5 lakh, with in-hand closer to ₹3.8–₹4.3 lakh yearly. At senior stages, annual take-home can reach ₹8–10 lakh or more, factoring in experience and promotions.

MP Patwari Probation Period & Increment Pattern

New appointees typically serve a 2-year probation (first 6 months often training-focused), with salary sometimes starting at reduced percentages (like 70–90% in early years per some state patterns). Full pay and normal annual increments kick in after confirmation.

MP Patwari Job Profile & Work Responsibilities

Key Duties of MP Patwari

You'll maintain village land records, update revenue registers, measure plots for mutations, assist in revenue collection and inspections, handle land-related disputes, and support farmers with government schemes—mostly field-based work in rural areas.

MP Patwari Career Growth & Promotion

Promotion Hierarchy

Progression follows merit and service rules:

-

MP Patwari (entry).

-

Senior Patwari / Revenue Inspector.

-

Naib Tehsildar.

-

Tehsildar (often after 20+ years).

-

Higher roles like District Revenue Officer.

Each step upgrades your pay scale, allowances, and responsibilities for meaningful career advancement.

MP Patwari Salary Slip 2026

Your monthly slip details basic pay, DA, HRA, TA, other add-ons, then NPS, tax, and minor deductions. It's essential for loans, tax returns, income proof, and tracking your service record.

Factors Affecting MP Patwari In-Hand Salary

Key variables include your posting (urban vs. rural for HRA/TA), current DA rate, promotions or MACP benefits, and personal deductions like tax bracket.